The science behind Optimal Transport

A brief history

Optimal Transport (OT) originated in 1781 with Gaspard Monge, who posed the problem of optimally moving mass between distributions. In the 1940s, Leonid Kantorovich, reformulated the problem using linear programming, making the problem solvable and earning a Nobel Prize for its economic implications.

OT has since become a cornerstone of modern applied mathematics, powering advances in machine learning, image analysis, dynamics and probability theory. At its core, OT provides a principled way to compare and map probability distributions while minimizing a transport cost.

Major contributors to 21st-century advances include J-D. Benamou, Yann Brenier, Alessio Figalli, Wilfrid Gangbo, Gregoire Loeper, Robert McCann, Gabriel Peyré, Vladimir Sudakov, Cédric Villani, and many others.

At genOTC, we pioneer the use of Optimal Transport

to solve financial model calibration.

Volatility calibration has been a core challenge in financial markets since the development of option pricing models in the 1970s. Unlike price, volatility is not directly observable—it must be inferred from market data, particularly from option prices. Accurately capturing its dynamics is essential for derivatives pricing, risk management, and volatility trading strategies.

Volatility is tricky—it changes with market conditions and can behave very differently depending on the option’s strike or maturity. Because of this, we need models to capture how it moves. But here’s the catch: we can’t observe volatility directly. We only see clues about it through option prices. These prices often form patterns—like the market smile—that reflect how complicated volatility really is.

The goal is to find a model that can match this pattern. This process, called calibration, is key for anyone who wants to price derivatives accurately. While many methods have been around for decades, we take a fresh approach. Instead of just minimizing pricing errors, our approach thinks of calibration as aligning two distributions—what we see in the market, and what our model predicts.

Using Optimal Transport allows for greater stability, geometric interpretability, and robustness.

Revolutionizing Volatility Calibration

Traditional approaches to volatility calibration fall into two main categories

Implied Volatility Interpolations

Interpolating implied vols across strike and maturity is standard—but flawed:

- The interpolation in strike is usually a parametric interpolation at each listed maturity, therefore relying on some a priori assumptions on its shape.

- Lacks a fundamental connection to a dynamic model, and can lead to arbitrage opportunities.

- This implied volatility parametrization does not allow in itself to price OTC products.

Parametric Models (Dupire, Heston, SABR, etc.)

These models are widely used but structurally limited they rely on a few of parameters, therefore their calibration capabilities are very limited:

- Assume a predefined structure for volatility dynamics.

- Dupire’s local volatility model, while theoretically sound, is highly sensitive to noisy market data, often resulting in unstable volatility surfaces.

- Heston and SABR models impose rigid structures that may not align well with real market behaviors, requiring frequent recalibration.

- Any change to a model parameter requires full recalibration, making these models impractical in fast-changing market environments.

How genOTC Uses Optimal Transport in Volatility Calibration

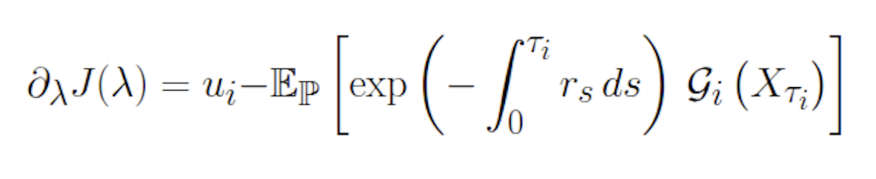

genOTC applies Optimal Transport to reconstruct a consistent, arbitrage-free volatility surface by solving a constrained optimization problem:

It minimizes a model « energy » or entropy, under the constraint that the model prices match observed option prices.

It therefore goes directly from market data to a model, without taking the usual way of interpolating/extrapolating the implied vol and then using this as input in Dupire’s formula.