Wednesday, November 5 • 8:45 a.m. – 11:00 a.m. GMT

Vintry & Mercer, 19-20 Garlick Hill, London, EC4V 2AU, UK

Attendance by approval only — RSVP: https://luma.com/x3p0ilaa

A Morning of Insight Where Finance Meets Craftsmanship

Join genOTC in Paris for an exclusive morning of insight and innovation, where the precision of quantitative finance meets the timeless artistry of Swiss watchmaking.

Hosted at Vintry & Mercer, this intimate breakfast gathers professionals in quantitative research, trading, financial risk management, and more. Together, we’ll explore how cutting-edge mathematics — specifically Optimal Transport theory — is transforming volatility calibration models and redefining what precision means in modern finance.

Innovating Volatility Modeling

This private breakfast offers an exclusive look at the latest advances in local volatility modeling, stochastic volatility models, and Optimal Transport in finance — key tools shaping modern quantitative risk solutions.

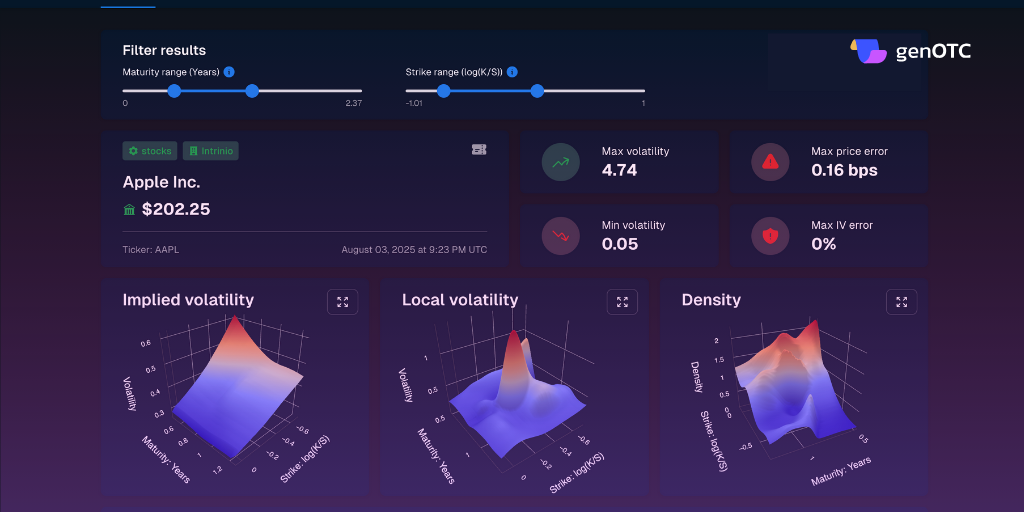

Attendees will see how genOTC, a next-generation SaaS platform, turns complex mathematics into robust pricing and risk analytics software. Designed for scalable, arbitrage-free , and real-time calibration, genOTC helps traders, quants, and risk professionals make confident, accurate, and consistent data-driven decisions.

Precision in Practice

Volatility modeling demands more than intuition — it requires mathematical finance models that are stable, repeatable, and computationally efficient.

Once purely theoretical, Optimal Transport technology for finance now powers actionable solutions across markets, ensuring robust pricing. arbitrage -free surfaces, and quantitative portfolio optimization.

Participants will gain a practical understanding of how stochastic process modeling and optimal transport come together in genOTCs platform to deliver operation precision and speed.

Where Finance Meets Craftsmanship

The event also celebrates precision in both art and science, with a collaboration featuring Ulysse Nardin, the renowned Swiss watchmaker. Just as every gear in a timepiece must work in harmony, each component of a volatility surface model must be finely tuned.

Over coffee and fine pastries, guests can engage in open discussions with peers and leaders in quantitative finance, risk modelling, research, trading, and algorithmic trading models – blending intellectual depth with the elegance of fine craftsmanship.

Inside the Event: Three Sessions of Insight and Innovation

1. From Monge (1781) to Black–Scholes–Merton (1973): Derivatives Pricing, Volatility Calibration, and Optimal Transport

The journey from classical mathematics to modern financial derivatives pricing and markets comes alive in this opening talk.

Loeper will demystify the complex world of calibration, explaining why model calibration lies at the heart of options pricing models, and how Optimal Transport provides a mathematically elegant, computationally efficient solution. You’ll learn how centuries of mathematical evolution have led to this feat in volatility modeling, one that blends theoretical rigor with real-world practicality.

Speaker: Gregoire Loeper, CEO, genOTC

2. From Models to Markets: Precision That Pays Off

Volatility isn’t just a number — it’s the pulse of the market.

This session examines how small modeling errors in quantitative risk management software can cascade across trading desks, risk and pricing systems, portfolios, and valuations.

Learn about how robust volatility surfaces, stress testing financial models, and scenario testing in finance directly improve risk-adjusted returns and portfolio performance.

The takeaway: precision isn’t theoretical — it’s profitable.

Speaker: Marion Olives, Structured Product & Derivatives expert

3. Live Demo — From Theory to Practice: genOTC in Action

Theory meets technology in this live demonstration of genOTCs local volatility calibration and quantitative finance tools.

See how Optimal Transport-based calibration integrates seamlessly into existing risk management software for traders, providing Value-at-Risk calculation and volatility forecasting for traders.

Speaker: Joaquin Sanchez, Senior Quant (Core), genOTC

Why You Should Attend

This isn’t just another finance event — it’s a curated experience for professionals that value precision, innovation, and quantitative rigor.

You’ll gain:

- Expert insights into stochastic volatility models and volatility calibration models from one of the world’s foremost experts

- Understanding of how Optimal Transport in finance enhances advanced pricing models

- Early access to genOTCs financial risk analytics software

- Networking with leaders in quantitative finance, risk management, and more

Seats are strictly limited, and attendance is by approval only. Early registration is recommended.

Event Details at a Glance

Venue: Vintry & Mercer, 19-20 Garlick Hill, London, EC4V 2AU, UK

Date: Wednesday, November 5

Time: 8:45 a.m. – 11:00 a.m. GMT

Registration: By approval only

RSVP: https://luma.com/x3p0ilaa

Experience the Art and Science of Precision

Finance, like watchmaking, thrives on precision — every component must align perfectly to achieve balance, accuracy, and trust.

Join us this November in Paris to explore how Optimal Transport and genOTC’s volatility calibration models and platform are redefining the standards of quantitative finance solutions for modern markets

Come for the insights, stay for the conversation, and leave inspired by precision — in both mathematics and craftsmanship.