I have been going through all the research papers of Gregoire Loeper, I am truly impressed by the model developed by genOTC. For accurate pricing, valuation, and risk management of a derivatives portfolio, it’s crucial to use a robust volatility surface. genOTC has developed an impressive approach to calibration issues, both very accurate and agile.

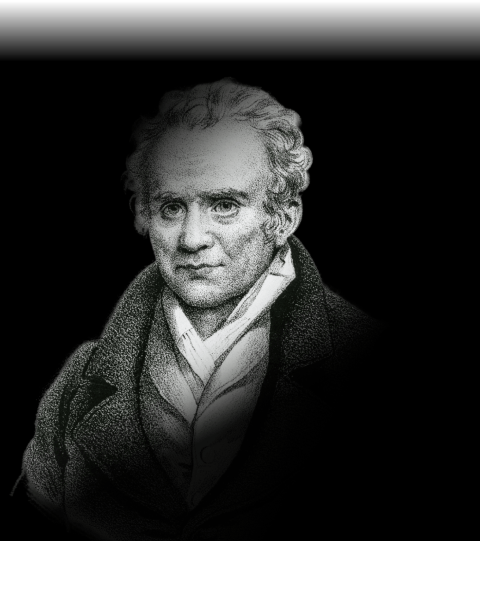

Julien Guyon, Quant of the Year, Risk Awards 2025

Real-time, Marked-to-Market Pricing

On the fly exact calibration, instant results.

Asset Managers

Transparent, reliable valuations– ability to price independently structured products, tool for efficient risk management, and for supporting trading strategies or portfolio management.

Hedge funds

Precision under pressure – our models adapt to market movements in real-time, built for alpha discovery and risk management.

Consultants & Accountants

Accurate pricing for identifying business opportunities. On the fly independent pricing for multiple types of assets and derivatives.

Investment Banks

Cross-asset calibration without the headache. Direct plug-in to your workflow and build arbitrage-free pricing at scale.

Bulletproof Calibration and Pricing, Synced with Your Data

Starting from actual market data genOTC builds an arbitrage-free model that fits market prices accurately, delivering flawless, real-time calibration.

100% cross-asset

Compatible with any market data

Zero integration effort

Optimal Transport

A revolution in model calibration.

What if the math behind moving sand piles could move markets?

Born from a centuries-old puzzle, Optimal Transport is ready to challenge how we price risk and model volatility. At genOTC, we translate this deep theory into real-time market insight. If there’s a fit, we will find it.

Traditional volatility calibration is mostly a parametrisation of the implied volatility.

It does not provide a pricing model or the ability to price OTC products. We do!

Powered by optimal transport, a breakthrough mathematical tool, genOTC generates a marked-to-market pricing model on the fly.

How We Make the Difference

Traditional frameworks unable to capture today’s market complexity

Parametric volatility models hobbled by oversimplified assumptions

Lack of general framework: models are unstable across assets and universes

Numerical complexity needs to be resolved in each specific case

Cutting-edge pricing powered by Optimal Transport

Real-time, adaptive calibration of local volatility surfaces

Modern quant tools built for teams who demand edge

Natively arbitrage free

Explore how Optimal Transport is shaping the future of model calibration